Q2 2022, GTA Real Estate’s Turning Point from the High

From the beginning to the end of Q2 2022, we were feeling lower popularity in residential homes and finally got all the data proving that the GTA’s real estate’s peak inflection point has officially arrived.

When the market is still surging in the first quarter, many people knew that the turning point would come, but for most of the many people, such rationality can not be translated into the right action in the right time, which is why the craziness of real estate market escalated several times until Q2 2022. to be accurate I think March 1st is the time the concert started to stop, and the whole quarter 2 market is adjusted by all the participants with a different pace of understanding the situations.

Like I ever talked to one of my clients who want to sell his home in Toronto in April reminding that we have to be aware the markets were turning in a reverse direction. Here is the Simple and Key Data:

- First, the second quarter’s Sold Units was down 15% from the first quarter and 40% from the same period last year!

- Second, the average house price in the second quarter fell 7% from the first quarter, but was still 10% higher than the same period last year;

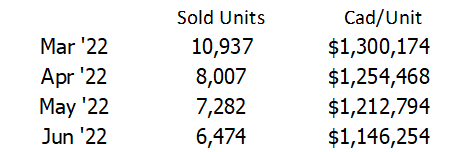

Let’s zoom in and look closely at the April-June period of 2022, the findings are: the 3 months were continually going down both in Sales and Average Price:

If you calculate the average price in June and the average price in March, the decrease is 11.8% which is higher than the 7% decrease in the second quarter mentioned earlier. why? because we see it more finely! You agree that we have to add time to data to make it meaningful, right? This is a little bit like the moving average theory in analyzing the stock price in the equity market. The market goes bearish and falls, and the short-term average declines more than the long-term average, which means that the current market is continuing to decline. The trading volume decreases every month, which means that the popularity is low; the average unit price of the transaction moves down, which means that buyers and sellers can reach an agreement on a lower price.

At the time of writing, it was already mid-July, and the housing market continued to adjust, but In the second quarter, the Toronto area real estate residential rental market is hot!

I already have a professional feeling that every time a property sale is light, renting will grab the eye!

Ontario’s average rent for the second quarter was 2171 per unit, up 10% from the same month last year at 1977 per month and up 5% from the first quarter.

Those who give up home buying plans will naturally choose to rent, since the rental market was turning to become more active. While the interest expense of a home mortgage is on the rise, the rising rentals do help some landlords of investment properties against some of the increased loan costs.

Ontario’s average monthly rent per square foot reached $3.67, second only to Vancouver’s $4.09 per square foot. This indicator is not commonly used in Canada. More data provided by our industry is the monthly rental amount of each unit. The size of each unit can range from 400-1200 square feet, so obviously the monthly rental rate per square foot can be more accurate. Compare apartment costs. If your apartment is 700 square feet and rents at 2,569 per month, then the monthly rent per square foot is 3.67.

Rent is a real estate variable included in the CPI data. The current inflation rate in Canada is 7.7%, and the annual increase in rent is 10%. Obviously, rent is a direct factor in rising prices.

Now the residential market is cold, Can we not talk about the most extreme interest rate hikes in the recent quarter century?

The central bank interest rate at the end of June 2022 increased from 0.25% at the beginning of the year to 1.5% in June. If you have to calculate the multiple of the increase, then the Bank of Canada interest rate,

- In the second quarter of 2022, a five-fold (500%) increase from 0.25% in the same period last year;

- Compared with the 0.5% at the end of the first quarter of 2022, it has increased three times (300%) from the previous quarter!

- We know that the rate hike is not over when the 75bps on July 13th was ever expected by all the banks as a certainty…and yet July 13th came with an announcement of more than 100bps than ever expected.

In fact, political talks about real estate control have long been brewing since the fourth quarter of last year, when I paid attention to the elaboration of real estate policies by various parties. The real policy change is after the Christmas and New Year’s Day holidays, plus the government’s approval and decision-making time for about a month. The Canadian government’s first shot at real estate reform has finally come. At the end of February this year, it promulgated a ban on foreigners from purchasing residential houses in Ontario and implemented it immediately; on March 2, 25 interest rates were raised moderately. Then, the Bank of Canada raised interest rates by 100 basis points in April and June consecutive months in the second quarter, from 0.25% to 1.5%.

Bank of Canada Meeting Schedule for 2022

Date Target Overnight Rate Change

March 2, 2022 0.50% 0.25%

April 13, 2022 1.00% 0.50%

June 1, 2022 1.50% 0.50%

July 13, 2022 2.5% 1.00%

September 7, 2022 To Be Decided —

October 26, 2022 To Be Decided —

December 7, 2022 To Be Decided —

The third quarter may also be a season in which GTA real estate market will continue to adjust

The high point of residential prices in the first quarter was 50% higher than two years ago before Covid, by simple calculation we got an average annual increase of 25%, but this increase was not reflected in the increase in CPI, because rent indirectly reflected real estate prices to CPI indicator tool. An increase in the price of a property is an increase in the so-called Increase in Asset Price.

As a homeowner, is it strange that you see your house value appreciate by 25% annually, well above the current high inflation of 7.7%? It’s very interesting, but it’s very easy to understand that, from the aspect of the seller who still thinks that their house will sell for at an as good as or higher price like what was sold by one neighbor at the record high price in the first quarter in 2022.

The market always changes suddenly, and the change never catches up with the change itself. I see that in today’s society with social media is highly developed, and there are many channels for people to get the right information as long as they are willing. If you can follow a little faster, it will increase the odds of winning.

I hope I can provide you with a reflection on my experience as a salesperson and a thinker in real estate. My goal is not to predict the market, but to help my clients to understand the state of the market at different times, and Eventually, to help home Buyers/Sellers make decisions based on market trends and personal needs!

As reflected in Canadian Statistical Report in June, the proportion of real estate investment went up to 22% by 3 points compared before Covid-19; and we should reasonably assume that investors normally are the most sensitive group to the mortgage rates, With still hawky tone about future interest rate hikes the speculative demand will continue to be the frontier of the fastest shrinking.